Mon - Fri 8.30am - 5.00pm

An article by Becky Calvert, Protection Consultant Specialist: Becky@charleslouis.co.uk

When it comes to income protection, it has always been a question of priorities. ‘It won’t happen to me’ is one of the main reasons many of us view the importance of certain policies over others.

In a study by Cirencester Friendly, they found that 30% of people interviewed would take out mobile phone insurance but had not considered income protection. In the same study, people were twice as likely to insure their pets as they are to take income protection.

An estimated 141.4 million working days were lost because of sickness or injury in the UK in 2018, the equivalent to 4.4 days per worker. This year, the level of sickness could increase further due to the impact of COVID19 and potential side affects. In this article we answer some of the key questions our customers ask and review will income protection provide the next comfort blanket for families?

It will be no surprise to hear that at the start of the pandemic lockdown, requests for income protection increased dramatically and insurers have paid out significant sums in the past four months. Whilst the levels of income protection enquires are now back to normal, it is worth highlighting the benefits, not least to dispel the myth of how, why and when claims will be paid out.

Do I need income protection?

Statutory Sick Pay will pay out £95.85 per week. According to the ONS Family Spending report in 2019, the average UK household budget was £2,500 based on an average of 2.4 people per household. For most families, the SSP is their shopping bill for just one week.

Another striking statistic is that the average UK employee has enough savings to sustain themselves for 32 days (‘Deadline to the Breadline’ report Legal & General).

Income protection will cover you for anything that medically prevents you from doing your job, including accidents, illnesses, injuries and mental health.

If I have life insurance, do I need income protection?

Income protection can be compared to an extension of your sick pay. In 2018, Ageing Better documented that 25% of 25-49 year olds have a long-term health condition and this figure rises dramatically to 44% of those aged 50-64. Royal London, noted that the average age for a claim was 40 years in 2019.

Life insurance cover only pays out one lump sum on death or terminal illness, while income protection pays you a regular income until you are fit to go back to work or you retire and it is tax free. However, income protection can be bought alongside life cover.

Which illnesses or medical conditions are protected under income protection?

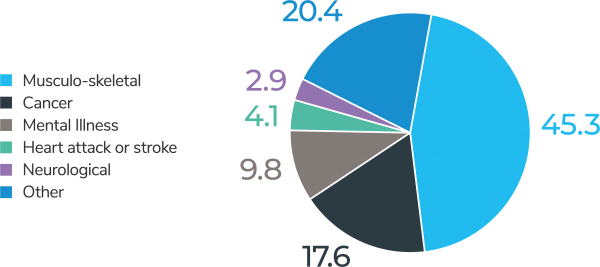

This can vary by insurer however according to Royal London their claims breakdown for income protection was as follows. We can do a nice graph for this and will add some imagery to it.

What is the difference between short term and long term income protection?

Short-term income protection insurance will cover you for a fixed amount of time, for example one, two or five years. Once you return back to work, some insurers will allow you to top back up after six months of being back at work. Long-term income protection is designed to cover your monthly income right up until retirement age or an agreed time period should you be unable to work due to illness or injury.

Will I be covered for COVID19?

COVID19 is an unprecedented pandemic and for many policyholders there would have been a great deal of uncertainty. However, income protection is designed to support you during the time that you are not able to work due to medical conditions.

This month, Aviva launched its COVID19 income protection rehabilitation support. For long term income protection policy holders, their cover is likely to have kicked in from day one, and now that there is the potential of the ongoing effects of those infected by COVID19, insurers like Aviva will be looking to support their customers’ recovery to get back to work.

What about mental health?

According to MIND, 1 in 4 people will experience a mental health problem of some kind each year in England. With some insurers, income protection can cover you for areas such as stress or depression that seriously impacts your ability to work for many months or years – something that would not be covered by Critical Illness, for example.

Putting this into perspective, COVID19 alone has caused concern for many employers including the NHS where staff absence increased by 165,000 days during lockdown due to mental heal issues. https://www.telegraph.co.uk/news/2020/08/01/mental-health-toll-nhs-workers-lockdown-revealed-first-figures/

We are living in uncertain times and life can take its toll. As markets become more volatile and industry sectors decline, in our view income protection is one of the most vital security measures we can take. It is just a question of priorities.

Posted by admin

FCA Regulated

Whole Market Access

Expert Advice

Great Feedback